Account Description Does Not Tally – Return Reason Removed

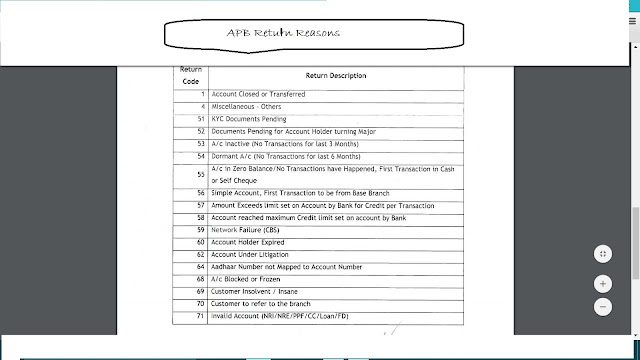

NPCI vide circular No 177, dated July 28 th , 2016, informed the Banking community that the APB Return Code NO 3 – Account Description does not tally is removed from the valid return reasons. As the participants have to make necessary changes in their Software, the effective date of this circular is September 1 st , 2016. It may be noted that the ‘Beneficiary Name’, is an Optional field and the Sponsor Bank may choose NOT to incorporate the Beneficiary Name in the input field. NPCI has observed that few banks are mapping the return records of ‘Aadhaar not mapped to the account number’, to ‘Account Description Does Not Tally’. This was leading to unnecessary confusion and customer complaints. Hence, as the return reason ‘Account Description Does Not Tally’ is not valid for APB transactions a decision was taken to remove it. The List of valid APB Return codes are as under:- It may b