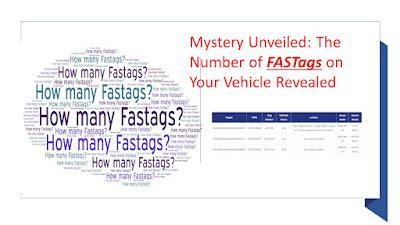

Unlocking the Curious Factor: How Many FASTags Does Your 4-Wheeler Have?

Behind the Windscreen: The Untold Story of Your Vehicle's FASTags Just enter your Vehicle Number @ https://www.npci.org.in/what-we-do/netc-fastag/check-your-netc-fastag-status Introduction: In the realm of four-wheeler experiences, where each journey tells a unique story, there exists a small yet powerful enigma – the FASTag. Every vehicle owner or frequent passenger harbors a trove of memories tied to this inconspicuous electronic toll collection device. It's more than a mere gadget; it's a gateway to a myriad of experiences, both delightful and challenging. Picture this: you're on a road trip, cruising through toll plazas, and there it is – your FASTag, silently orchestrating the toll payment process. Now, have you ever stopped to wonder, "Do I really know the number of FASTags my four-wheeler has?" This question assumes a curious factor, transcending the utilitarian aspect of toll collection to delve into the very essence of your vehicl