Unlock 1 – Digital Transactions to zoom up, skyrocket

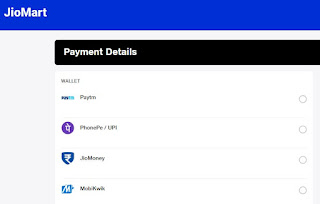

Government of India, Ministry of Home Affairs just announced the operating guidelines for Unlock 1. These guidelines are effective until 30 th June 2020. As the focus of Unlock 1 is mainly on the economy, it is expected that regular economic transactions will come back to pre-Lockdown numbers. The focus in the last couple of months is on Digital Transactions especially Contactless Transactions. Digital transactions are those economic transactions in which the consideration is executed via Non-Cash modes. Few examples of Digital transactions are as under o Cheque o Card to Card Transfer o IMPS o NEFT o RTGS o eWallet o UPI o POS Transactions o AEPS o USSD o Prepaid cards · BBPS transactions too fall under the wide umbrella of digital transactions as the customers need not physically visit the bill payment counters of the respective billers. The bills can be settled via B