UPI “On-device” wallet – How it may look

UPI “On-device”

wallet – How it may look

These are my personal views

only. ‘The bottom line is Safe

ePayments. Nothing more, Nothing less’

Reserve

Bank of India, Shri Das on 8th December 2021, announced a major addition to the

UPI ecosystem

Quote

(ii) make the process flow for small value

transactions simpler through a mechanism of ‘on-device’ wallet in UPI

applications;

UnQuote

The

accompanying Reserve Bank of India, gave a glimpse of “On-device” wallet in UPI

app.

6.

Simplification of Process Flow for Small Value Transactions over UPI

UPI is the

single largest retail payment system in the country in terms of volume of

transactions (14 crore transactions per day, October 2021)3.

One of the

initial objectives of UPI was to replace cash for low value transactions.

Transaction data analysis shows that 50 per cent transactions through UPI were

below ₹200, indicating its success.

These low

value transactions, however, utilise significant system capacity and resources,

at times leading to customer inconvenience due to transaction failures because

of issues related to connectivity.

It is,

therefore, proposed to offer a simpler process flow by enabling small value

transactions through an “On-device” wallet in UPI app which will conserve

banks’ system resources, without any change in the transaction experience for

the user.

UPI “On-device”

wallet – How it may look

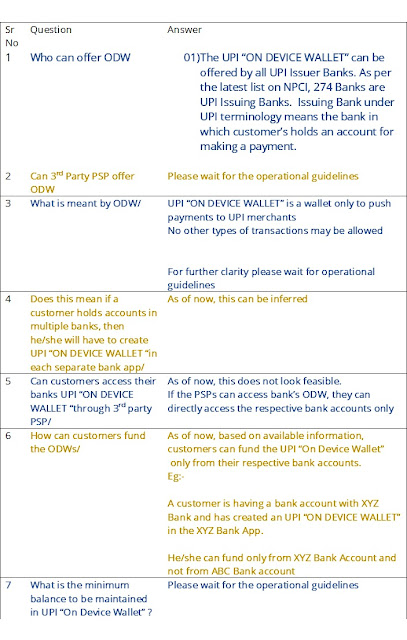

Once Reserve Bank of India and NPCI releases

tech specs of ODW, there will be more clarity on the thought process.

As of now, the UPI “ON DEVICE

WALLET” has moved a step closer from FinTech Fiction to Reality.

Comments

Post a Comment