Indian e₹ (Digital Rupee) - Models (Direct, Indirect or Hybrid)

Reserve Bank of

India, in the Concept paper on Issuance of Concept Note on Central Bank Digital

Currency, released to the public on Oct 07, 2022

The concept

paper can be read @ https://rbidocs.rbi.org.in/rdocs/PublicationReport/Pdfs/CONCEPTNOTEACB531172E0B4DFC9A6E506C2C24FFB6.PDF

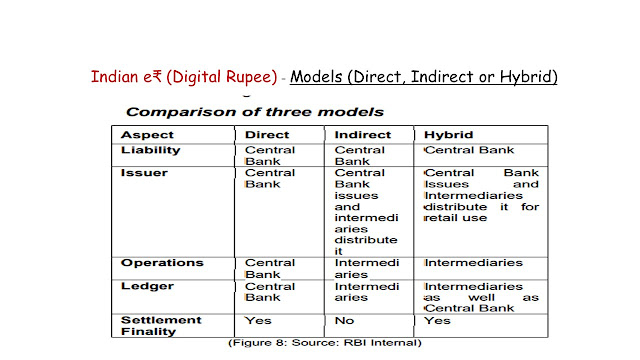

(ii) Models for issuance and

management of CBDCs (Direct, Indirect or Hybrid model),

Highlight A) Direct –

Direct claim on the Central Bank

Highlight B) Indirect

- Indirect claim on the Central Bank via intermediaries

Highlight C) Hybrid –

Hybrid claim on the Central Bank, but with a backup infrastructure

There are three models for the issuance and management of CBDCs across the globe.

The key differences lie in the

structure of legal claims and the record kept by the central bank

A) Single Tier model - This model

is also known as the “Direct CBDC Model”.

A Direct CBDC system would be one

where the central bank is responsible for managing all aspects of the CBDC

system including issuance, account[1]keeping,

transaction verification et. al.

In this model, the central bank

operates the retail ledger and therefore the central bank server is involved in

all payments.

In this model, the CBDC

represents a direct claim on the central bank, which keeps a record of all

balances and updates it with every transaction.

The major disadvantage of this

model is that it marginalizes private sector involvement and hinders innovation

in the payment system.

This model is designed for

disintermediation where the central bank interacts directly with the end customers.

This model has the potential to

disrupt the current financial system and will put an additional burden on the

central banks in terms:

of managing customer onboarding,

KYC, and AML checks, which may prove difficult and costly to the central bank

B) Two-Tier Model (Intermediate

model) The inefficiency associated with the Single tier model demands that

CBDCs are designed as part of a two-tier system, where the central bank and

other service providers, each play their respective role.

There are two models under the

intermediate architecture viz. Indirect model and Hybrid Model.

Indirect Model- In the “indirect

CBDC” model, consumers would hold their CBDC in an account/ wallet with a bank,

or service provider.

The obligation to provide CBDC on

demand would fall on the intermediary rather than the central bank.

The central bank would track only

the wholesale CBDC balances of the intermediaries.

The central bank must ensure that

the wholesale CBDC balances are identical with all the retail balances available

with the retail customers

Suppose the central bank issues e₹

(Digital Rupee) of say 50 crores. These 50 crores will get distributed to a

large pool of individual customers via intermediaries. Say 5 intermediaries.

At the end of each day, the total

e₹ (Digital Rupee) held by 5 intermediaries should be equal to 50 crores.

The internal balances held by each

intermediary may change daily.

The central bank will not have a track of individual e₹ (Digital Rupee) account balances in each intermediary or

the transactions.

The main disadvantage of this

model, is that if any intermediary fails, it will be difficult for the

respective intermediaries' account holders to access their e₹ (Digital Rupee) or

retrieve past transaction details.

Hence, this model is rarely adopted.

This is where the Hybrid Model

holds promise.

Hybrid Model- In the Hybrid

model, a direct claim on the central bank is combined with a private sector

messaging layer.

The central bank will issue CBDC

to other entities which shall make those entities then responsible for all

customer-associated activities.

Under this model, commercial

intermediaries (payment service providers) provide retail services to end

users, but the central bank retains a ledger of retail transactions.

This architecture runs on two

engines:

intermediaries handle retail

payments, but the CBDC is a direct claim on the central bank, which also keeps

a central ledger of all transactions and operates a backup technical infrastructure

allowing it to restart the payment system if intermediaries run into insolvency

or technical outages.

This way, the end customers need not

worry about the stability of the intermediaries. In case of any issue with the intermediary,

RBI may take a decision to shift the e₹ (Digital Rupee) from one intermediary to another intermediary

with minimal disruption.

Plan for India - Indirect System e₹

(Digital Rupee)

Considering the merits of

different models, the Indirect system may be the most suitable architecture for the introduction of CBDC in India.

As per the RBI Act, 1934, the

Reserve Bank has the sole right to issue bank notes, which has now been amended

to include currency in digital form also.

Therefore, in this model, RBI

will create and issue tokens to authorized entities called Token Service

Providers (TSPs) who in turn will distribute these to end-users who take part

in retail transactions.

The rationale behind the same are

as given below:

(i) In the entire supply chain,

there are a wide range of customer-facing activities where the central bank is

unlikely to have a comparative and competitive advantage as compared to banks,

especially in an environment where technology is changing rapidly, which

inter-alia includes distribution of CBDCs to the public, account-keeping services,

customer verification such as KYC and adherence to AML/CFT checks, transaction

verification, etc .

(ii) Banks and other such

entities have the expertise and experience to provide these services.

(iii) These entities can provide

their customers with the ability to transact in and out of CBDC and thus can

enrich the customer experience and may facilitate wider adoption of CBDCs

Disclaimer: These are my personal thoughts only. The bottom

line is Safe ePayments. Nothing More – Nothing Less.

Any errors, belong to me.

Copyrights, if any, belong to the original copyright holder

only.

#stealtime

Comments

Post a Comment