UPI Auto Pay

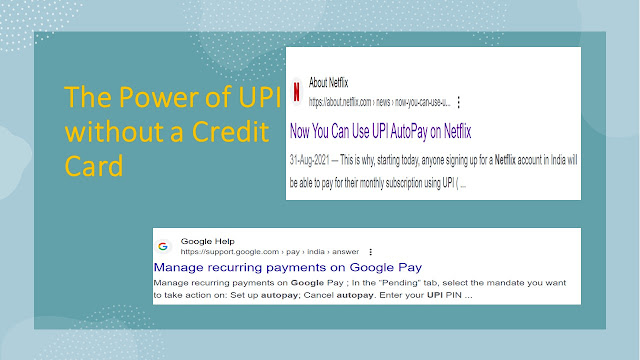

UPI Auto Pay volumes are slowly and steadily increasing. Yes, UPI AutoPay introduced by NPCI is another way to pay your recurring bills. There are multiple benefits associated with UPI AutoPay.

Few

more tweaks can add value to the AutoPay journey.

The

National Payments Corporation of India (NPCI) has ushered in a game-changing

feature with the introduction of AutoPay for recurring payments.

This

innovative functionality empowers customers to effortlessly set up recurring

e-mandates through any UPI application, simplifying the management of recurring

expenses such as mobile bills, electricity bills, EMI payments,

entertainment/OTT subscriptions, insurance premiums, and mutual fund

investments, among others.

AutoPay

offers a multitude of benefits to both customers and merchants. For customers,

it translates into timely payments, eliminating the hassle of late fees and

penalties.

The

flexibility of choosing payment frequencies, whether monthly, quarterly, or otherwise,

and setting customized amounts ranging from a mere Rs. 1 to a substantial Rs.

15,000+ for each mandate, ensures that every individual's financial needs are

catered to.

Furthermore,

the ability to modify, revoke, or pause mandates as needed adds an extra layer

of convenience and control.

This is

not only a secure way to handle recurring payments but also promotes cashless

transactions, eliminating the need to stand in long queues and deal with

cumbersome paperwork.

Merchants,

on the other hand, stand to gain significantly from AutoPay. The streamlined

registration process ensures quick onboarding, reducing turnaround time and

administrative overhead.

Merchants

can count on timely payments from their customers, leading to improved customer

service, satisfaction, and retention.

By

offering this convenient payment method, merchants can build trust with their

customers and ultimately expand their customer base.

With all

possible registration flows available, AutoPay becomes a versatile tool for

businesses of all sizes to manage recurring payments efficiently.

In

addition to the convenience and flexibility, AutoPay offers a secure and

cashless way to handle recurring payments.

No more

standing in long queues or drowning in paperwork.

It's a

seamless experience for both customers and merchants. Merchants, too, stand to

gain immensely from this innovation.

The

streamlined registration process ensures minimal turnaround time, guaranteeing

prompt payments from customers.

This not

only enhances customer service but also fosters satisfaction and loyalty,

ultimately leading to an expanded customer base and the invaluable trust of

patrons.

With

AutoPay, all possible flows are available for registration, making it a

comprehensive solution for businesses of all sizes.

It's a

win-win for everyone in the digital payment’s ecosystem, marking a significant

leap towards a cashless, hassle-free future.

In

summary, NPCI's AutoPay is a win-win for both customers and merchants. It

modernizes and simplifies the way recurring payments are handled, ensuring

financial convenience, security, and efficiency for all parties involved.

Visit

this page to know more about ecosystem statistics @ https://www.npci.org.in/what-we-do/autopay/ecosystem-statistics

Disclaimer:

These are my personal views only. The bottom line is Safe ePayments.

Comments

Post a Comment