Revolutionizing Fixed Deposits: Moneycontrol's UPI-Powered Investment Experience

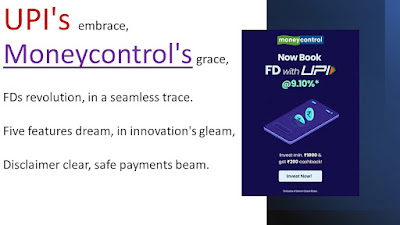

One more innovation around UPI. Now Moneycontrol offers to assist you to book Fixed Deposits via UPI payment channel.

So,

what are your thoughts on this? Wondering which is the backend technical partner

for this process.

Introduction:

In

the dynamic realm of financial technology, Moneycontrol once again takes a leap

forward by introducing a revolutionary feature - the ability to book Fixed

Deposits (FDs) seamlessly through the Unified Payments Interface (UPI).

This

innovative approach not only enhances the convenience of FD investments but

also aligns with the growing trend towards digital and contactless financial

transactions.

In

this blog post, we will delve into the four distinctive features that spotlight

Moneycontrol's commitment to leveraging UPI for an unparalleled FD investment

experience.

1.

High-Interest Rates and UPI

Integration:

Moneycontrol's

collaboration with prominent financial institutions ensures users access good interest rates on FDs. The standout feature,

however, is the integration of UPI

as the payment channel. This groundbreaking step streamlines the investment

process, allowing users to initiate and complete FD transactions seamlessly

through the UPI

platform. The synergy between high-interest rates and UPI integration exemplifies Moneycontrol's

commitment to providing users with a cutting-edge and efficient investment

avenue.

2.

Paperless, Online Process with UPI:

The

traditional hurdles of paperwork and physical processes are eliminated with

Moneycontrol's online FD investment platform. Leveraging UPI, users can complete the entire FD booking

and withdrawal processes without the need to open a new savings bank account.

The paperless and online approach aligns with the contemporary preference for

swift and hassle-free financial transactions, positioning Moneycontrol as a

pioneer in digital financial solutions.

3.

Effortless UPI-Based

FD Booking:

Moneycontrol's

user-friendly app ensures a seamless FD booking process with UPI as the focal point. Through the app, users

can effortlessly select their preferred bank, specify the FD tenure, input the

investment amount, and furnish necessary personal details. The incorporation of

UPI

facilitates the swift transfer of funds, making the entire process intuitive

and efficient. Moneycontrol's commitment to user-centric design is evident in

the simplicity and ease of use embedded in the UPI-based FD booking process.

4.

Instant UPI-Enabled

Premature Withdrawals:

Recognizing

the need for flexibility, Moneycontrol has streamlined premature withdrawal

processes with UPI.

Users can initiate premature withdrawals through the app, with the UPI platform facilitating instant

transactions. Notifications are promptly sent to the registered mobile number

upon successful withdrawal, and the FD booking is automatically removed

post-withdrawal. Importantly, there are no withdrawal processing charges,

underscoring Moneycontrol's dedication to providing cost-effective and

user-friendly financial solutions.

Conclusion:

Moneycontrol's

integration of UPI

into the FD investment process marks a transformative moment in the financial

technology landscape. By combining high-interest rates, a paperless online

approach, and a user-friendly UPI

interface, Moneycontrol sets a new standard for FD investments. As a part of

the Network 18 group, owned by the Reliance Group, Moneycontrol offers not just

innovation but also the assurance of the safety and longevity of your

investments. Whether you're a seasoned investor or new to financial markets,

Moneycontrol's commitment to leveraging UPI technology makes it a standout choice for

a modern and efficient FD investment experience.

The

future of FD investments on the Moneycontrol platform holds exciting

possibilities. By envisioning and implementing innovative features such as

AI-driven recommendations, interactive simulation tools, integration with

financial planning apps, and in-app educational resources, Moneycontrol can

attract a broader user base and encourage increased FD volumes. As the

financial technology landscape evolves, these features could set Moneycontrol

apart as a comprehensive and user-centric platform for individuals looking to

optimize their Fixed Deposit investments.

Future-Forward: 4 Innovative Features Moneycontrol Could

Introduce to Boost FD Volumes

To

further boost Fixed Deposit (FD) volumes on their platform, Moneycontrol could

consider incorporating these four innovative features, leveraging technology to

provide users with unparalleled convenience and value.

1.

AI-Driven Personalized Investment Recommendations:

Imagine

a Moneycontrol platform that employs artificial intelligence to analyze user

behavior, financial goals, and market trends. By leveraging AI, Moneycontrol

could provide personalized FD investment recommendations tailored to each user's

unique profile. This feature not only simplifies decision-making for investors

but also enhances the likelihood of users discovering FD opportunities that

align with their financial objectives.

2.

Interactive Investment Simulation Tools:

To

empower users with better decision-making capabilities, Moneycontrol could

introduce interactive investment simulation tools. These tools would allow

users to model various FD scenarios based on different tenures, interest rates,

and investment amounts. By visualizing the potential outcomes, users can make

informed decisions about their FD investments, fostering a sense of control and

understanding.

3.

Integration with Financial Planning Apps:

To

offer a holistic financial management experience, Moneycontrol could explore

partnerships or integrations with popular financial planning apps. This

collaboration could enable users to seamlessly sync their FD investments with

their overall financial portfolio, providing a comprehensive view of their

assets. The ability to track FDs alongside other investments would likely

attract users seeking a unified and streamlined financial management solution.

4.

In-App Educational Resources and Webinars:

Moneycontrol

could elevate user engagement by incorporating educational resources within the

app. This could include informative articles, videos, and even live webinars

conducted by financial experts. By fostering financial literacy, Moneycontrol

not only empowers users to make informed FD investment decisions but also

cultivates a community of knowledgeable investors. This feature not only adds

value to the platform but also positions Moneycontrol as a trusted source for

financial education.

Disclaimer: While exploring potential features to

boost FD volumes on Moneycontrol's platform, it's essential to clarify that the

focus of this discussion is strictly on the integration of UPI technology. The suggestions provided here

are tailored to enhance the UPI-powered

FD experience and do not extend beyond that scope. My enthusiasm lies in

promoting the seamless and secure nature of electronic payments through UPI. This disclaimer emphasizes my commitment

to the joy of spreading the 'Beauty of Safe ePayments' and underscores that our

insights are centered solely around UPI

innovation within the context of FD investments on the Moneycontrol platform.

Comments

Post a Comment