ChatGPT Go Promotion India – 7 FAQs in the HANUMAN Sequence 💳🇮🇳 | How ChatGPT & Stripe Perfected the ₹1 UPI Autopay Flow

ChatGPT Go

Promotion India Explained – The HANUMAN of Fintech and the Story Behind the ₹1

UPI Autopay Flow

When innovation meets empathy, technology earns trust.

The ChatGPT Go Promotion (India) shows this beautifully — a global product

tuned to India’s digital heartbeat.

In partnership with Stripe, ChatGPT’s payment setup evolved

from a ₹0 experiment to a ₹1 verification debit, instantly refunded yet deeply

meaningful. That single rupee symbolizes reliability, compliance, and care.

Reading through the ChatGPT Help

Center FAQs, I saw more than policy — I saw thoughtful design at

work.

And in that spirit, this post follows the rhythm of HANUMAN —

seven FAQs beginning with those letters, each revealing how trust, design, and

proportion define modern ePayments. 💳🇮🇳

Faith in systems, trust in

design, and the power of a single rupee.

After a peaceful evening walk, I revisited the ChatGPT

Go Promotion (India) FAQs — and found myself both intrigued and inspired.

The attention to detail displayed by the ChatGPT Acquisition Team and their Payments

Partner – Stripe shows how technology and trust can coexist beautifully in

India’s evolving fintech ecosystem.

Sections such as ₹1

Verification Step and Account

in Good Standing reveal thoughtful design, localized awareness, and genuine

respect for user confidence.

In honor of that spirit, this post follows a symbolic

structure — seven FAQs inspired by the letters of HANUMAN — a tribute to clarity, balance, and purpose

in modern digital systems. 🙏

H – How does the ChatGPT

Go Promotion work?

The promotion offers a 12-month free trial of ChatGPT Go

(worth ₹399/month) exclusively for Indian users. During this time, users enjoy

full benefits at no cost. Billing starts automatically after the free period —

unless cancelled before renewal.

This is not merely an offer; it’s a trust exercise between

user and platform, designed to demonstrate value before commitment.

A – Are

there multiple payment options available?

Yes. Stripe powers two ways to participate:

1. Credit or

Debit Card (Domestic/International)

2. UPI

Autopay – the backbone of India’s digital micro-mandate ecosystem.

This inclusive model bridges global billing standards and India’s

homegrown payment innovation, allowing users to choose what feels natural.

N – Now why

is there a ₹1 UPI debit?

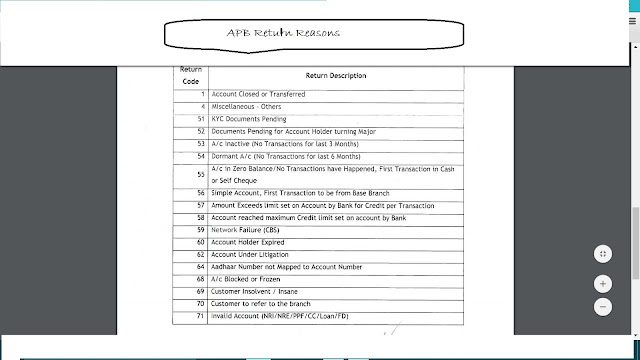

In earlier attempts, Stripe’s system tried a ₹0 authorization to

set up UPI Autopay mandates. Several Indian banks rejected that request due to

regulatory and system constraints.

The refined model now processes a ₹1 verification debit,

instantly refunded once the mandate is verified.

This micro-payment acts as a handshake between trust and compliance — ensuring

the user’s UPI ID and bank account are verified under NPCI UPI Autopay

guidelines.

💡 A

one-rupee proof of reliability.

📖 ₹1

Verification Reference

U – Upon

completion of the 12-month trial, what happens?

When the trial ends, the subscription renews automatically at

₹399/month via the verified payment method — whether card or UPI Autopay.

The earlier ₹1 verification ensures that this transition

happens seamlessly and securely.

No hidden charges, no failed mandates — just a smooth, transparent

continuation.

This flow shows maturity in design — test first, charge

later.

M – Meaning

of “Account in Good Standing”?

This phrase defines eligibility and continuity.

As OpenAI’s FAQ explains:

“Your account is in good standing if your account has no

missed or declined payments. If your account is not in good standing, you will

not be able to redeem the promotion till your billing period ends, and you

resubscribe after adding a valid payment method.”

It’s an elegant mechanism that encourages users to maintain

valid payment details and builds system stability — a vital principle in global

subscription management.

A –

Adaptations by Stripe & ChatGPT for India

What makes this rollout truly special are the localized

refinements:

- Integration

with NPCI UPI Autopay – ensuring seamless recurring mandates.

- Transparent

communication – each ₹1 debit/refund explained clearly in FAQs.

- Regulatory

respect – transitioning from ₹0 to ₹1 verification aligns with RBI and

NPCI compliance norms.

It’s not just a payment flow; it’s a study in how global

products adapt gracefully to Indian fintech frameworks.

N –

Navigating Safe ePayments: The Larger Message

Every small improvement in payment design — a line of code, a

refund loop, a FAQ paragraph — contributes to the larger mission of safe

digital finance.

The ₹1 verification may seem trivial, but it’s symbolic of a

much bigger value:

trust measured, verified, and refunded.

This is the same philosophy that underpins India’s payments

success story — transparent, inclusive, and built for confidence.

💭 The Awesome Thought Process

The ChatGPT Acquisition Team and Stripe India deserve immense

credit for their approach. They didn’t just fix a transaction failure — they

redesigned a user experience around reliability.

By blending empathy, clarity, and precision, they transformed

a technical challenge into an opportunity to strengthen user faith.

It’s a reminder that great design is never loud — it’s quietly consistent, like

the strength symbolized by Hanuman himself. 💫

🪶 What if UPI Autopay didn’t exist in India?

An interesting reflection.

Had UPI Autopay not existed, ChatGPT’s onboarding in India

would have been restricted to card-based billing. That would have alienated

millions who rely solely on UPI for digital transactions.

UPI Autopay changed that story. It gave OpenAI’s payment

framework a local heartbeat — turning global complexity into everyday

simplicity.

It’s proof that India’s fintech ecosystem isn’t just catching

up with the world; it’s quietly leading it. 🌏🇮🇳

🌈 Conclusion: The Joy of Safe ePayments 💳

The HANUMAN sequence stands for more than letters — it

represents harmony between human design and machine precision.

Every aspect of this rollout — the ₹1 verification, transparent help

documentation, and good-standing logic — reflects that principle.

When faith meets function, the result is trust.

And in India’s case, trust is measured in rupees — one rupee at a time.

So here’s to OpenAI, Stripe, and UPI Autopay — for showing how

modern fintech can be as mindful as it is magnificent.

Because in every verified ₹1 lies the true Joy of Safe ePayments. 💳✨

📚 References

1. ChatGPT

Go Promotion – India (OpenAI Help Center)

2. ₹1

Verification FAQ Section

3. Account

in Good Standing FAQ Section

4. NPCI – UPI Autopay

Overview

Citizen Advocate – Safe ePay Day

💳 April 11 – Safe ePay

Day (Proposed)

✨ UPI’s 10th Birthday – April

11, 2026

🌐 The Joy of Safe

ePayments

The Citizen Advocate Summary: Declaring

April 11 as Safe ePay Day, please explore

all related appeals here

🌿💳🧠🌍Appeal for Safe ePay Day 🌟

📚

References

1️⃣

Nayakanti, P. (2025, Sept 7). National Buy a Book Day and Safe ePay Day Medium

2️⃣ Nayakanti, P. (2025, Aug 13). 218th

Lalbagh Flower Show via RV Road Interchange! Blogger

3️⃣ LinkedIn Profile

Comments

Post a Comment