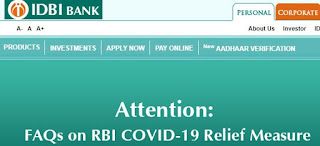

COVID19 – IDBI Bank FAQs on RBIs COVID19 Relief Measures

Reserve Bank of India vide ‘COVID-19 – Regulatory Package (Revised) RBI Lr No RBI/2019-20/186-DOR.No.BP.BC.47/21.04.048/2019-20 dt.March 27, 2020’, has announced a number of relief measures to minimise the COVID19 impact. The operating details are to be approved by the respective Bank’s / NBFC and updated on their respective website. In this regard, IDBI Bank has taken the lead. IDBI Customers on landing on the bank’s website can view the details banner on the first page itself. As of now, no other Bank or NBFC has uploaded the COVID19 relief measure’s operating details on their websites. Banks/NBFCs are expected to compile FAQs (Frequently Asked Questions) regarding RBI’s COVID Relief measures customised to their account holders and host the same. ...